Whoa!

I was staring at a token chart the other day and felt a knot in my gut.

Market depth looked shallow, and the price jumped on what seemed like tiny orders.

Initially I thought it was just pump noise, but then realized liquidity mechanics were rewriting the playbook for real-time tracking.

On one hand it’s technical, though actually it makes or breaks trades for everyday DeFi users who can’t watch every block.

Really?

Okay, so check this out—slippage isn’t just a math problem anymore.

Small pools can create outsized price moves when bots or whales interact with them.

My instinct said this was an edge for fast traders, but then I traced several sour trades back to misreads in on-chain liquidity snapshots which were outdated by seconds.

That delay matters a lot when a sandwich bot can eat your lunch within three confirmations.

Wow!

Liquidity pools are both the backbone and the trap of automated market makers.

They provide constant pricing, yet that price is only as good as the pool’s depth and recent activity.

On deeper pools, big orders breathe without wobble, but on shallow ones a few transactions can create noisy price swings that masquerade as real trends to the inattentive.

This has practical consequences for stop-loss placement, dollar-cost averaging, and arbitrage strategies that assume atomic price continuity.

Hmm…

Here’s what bugs me about token price tracking on DEXs.

Data sources vary wildly in speed and fidelity across chains and bridges.

Initially I trusted aggregate feeds, but after comparing raw contract events I found discrepancies that would cost skittish traders hundreds in slippage and fees on a single bad trade.

On the flip side, some aggregators smooth out noise so aggressively that they hide transient liquidity gaps, which is its own hazard for execution quality.

Seriously?

You can monitor liquidity visually, though that alone isn’t enough anymore.

Depth charts and tick data help, but the real advantage comes from combining on-chain event streams with mempool visibility.

I started pairing a real-time swap feed with mempool txs, and that combo flagged potential price-impact moves before they fully landed, which let me reroute orders into safer pools quicker than before.

That approach isn’t perfect—sometimes noise triggers false positives—but it’s a tangible improvement over static snapshots.

Whoa!

DEX aggregators changed the game by routing across pools to reduce slippage.

They search multiple AMMs, splitting orders to get better fills, but they also centralize routing logic in ways that can be opaque.

I remember a trade that executed across three pools, each with different fee tiers and oracle delays, and the final fill was worse than a single-pool execution because of poor gas estimation and stale price samples.

So while aggregator routing is a powerful tool, traders need to understand the underlying liquidity seams and execution assumptions to avoid surprises.

Really.

Token pairs and fee tiers matter more than token branding.

A popular token on a low-fee pool might look attractive, but if that pool lacks depth, your effective market price will be poor.

I used to chase “name brand” listings, though actually I learned to prioritize pools by depth, recent volume, and the presence of arbitrageurs who keep prices honest.

Volume that vanishes after a single block is vanity; sustainable depth is the real metric for confidence.

Whoa!

Okay, quick aside—oh, and by the way, oracles aren’t a panacea.

Time-weighted averages and Chainlink-style feeds help for long-term data, but they’re too slow for tactical trades and can be manipulated over short windows by coordinated swaps.

On many chains, the freshest signal still comes straight from on-chain liquidity events and a smart aggregator that ingests them fast.

That means tooling, not just trust in a single oracle, is becoming central to execution quality.

Hmm…

Here’s a candlestick truth—execution is where theory meets money.

You can predict price direction correctly and still lose if slippage, fees, and front-running kill the fill.

My heuristic now scores pools by three dimensions: depth, volatility, and routing transparency, which reduces ugly surprises but requires more setup.

It’s not glamorous, but it’s the sort of practical checklist that separates “got lucky” from “consistently profitable”.

Whoa!

A practical tip: watch liquidity provider behavior.

When LPs pull tokens for reasons like risk rebalancing or impermanent loss mitigation, pool depth evaporates fast.

I once tracked a set of LP wallet withdrawals and warned friends; they avoided losing much, while others got squeezed on exit.

So periodic audits of LP concentration and recent deposit/withdrawal patterns are low-effort, high-value checks.

Really?

Slippage models in aggregators should be your friend, not a checkbox.

Some aggregators show optimistic fills without modeling gas and reversion risk, and that paints an unfairly rosy picture.

I started cross-referencing aggregator quotes with simulated on-chain calls to sense-check the path, and that habit caught several routes that would have reverted mid-execution.

Yes, it adds latency, but it’s worth it when moving sizable sums relative to pool depth.

Whoa!

Now, about token price tracking interfaces—UX matters.

Clean dashboards that surface meaningful metrics let you act, and fast.

I favor tools that prioritize depth heatmaps and per-block volume over flashy marketcaps, since those are the signals that impact execution in the next minute.

One of my go-to references is the dexscreener official site which surfaces real-time swaps and liquidity snapshots in a way that’s actually usable when markets roll hard.

Hmm…

On-chain analytics are evolving into real-time decision engines.

Layering mempool watch, liquidity depth, and historical arbitrage presence yields a composite score that predicts execution risk better than any single metric.

I prototype that score in Python and then wire alerts to my wallet, so I’m not mentally juggling dozens of tabs when a coin starts moving.

It cuts stress, and—I’ll be honest—it’s slightly addictive to see a good alert before the rest of the market notices.

Seriously?

Regulatory noise and chain-level forks add a human element to liquidity behavior.

When uncertainty about a token’s legal status hits, LPs often retreat before retail traders do, and that creates asymmetric liquidity holes.

I’ve seen price discovery break precisely at those moments because the liquidity that validated a quote disappeared under regulatory pressure.

So staying attuned to off-chain news is still part of smart on-chain trading, weirdly enough.

Whoa!

Arbitrageurs are the market’s real-time balancers.

Their presence indicates efficient cross-pool pricing, and their absence signals opportunity or danger depending on context.

If arbitrage activity dries up, you might be looking at a fragile price that could gap wildly on a single order; conversely, lots of arbitrageurs often keeps the spreads honest and execution predictable.

Monitoring their trails—where they operate, how big their legs are—gives you a sense of systemic health that’s rarely shown on simple charts.

Hmm…

I’ve got a bias toward actionable simplicity.

Complex metrics are seductive, but unless you can reduce them to a trigger you act on, they just clutter the screen.

So my rule: build or use tools that give directional alerts tied to explicit execution decisions, not just pretty lines.

That way, when a pool starts thinning and mempool shows a heavy swap, you actually do something instead of staring at the chart and hoping.

Whoa!

On a practical level, always simulate fills before hitting confirm.

Many wallets and aggregator UIs provide a simulator or dry-run to estimate gas and whether a route reverts.

I double-check that, and sometimes I split orders across routes to minimize market impact, which feels low-key but is surprisingly effective.

It’s not sexy—just sound trade hygiene—and it saved me from two cringe trades in one month.

Really.

To wrap up this train of thought—though not to wrap up everything—liquidity depth, speed of data, and routing transparency are the tripod supporting solid DeFi execution.

My early impression was that price charts told the whole story, but reality is messier and more interesting.

On one hand the tooling keeps improving, but on the other hand attack vectors and fragmentation keep the market lively and risky.

I’m not 100% sure where the next breakthrough will come from, but I’m watching closely and testing aggressively.

Tools and habits that help

Here’s the thing—use the right dashboards and build small automations.

I rely on a mix of on-chain event listeners, mempool watchers, and a solid aggregator to route orders intelligently.

For quick checks and live token screeps (yeah, sometimes I type too fast), I use interfaces like the dexscreener official site to see swaps and liquidity changes without digging through raw logs.

Do small sims, respect slippage, and track LP behavior—those habits lower execution risk more than clever indicators ever will.

FAQ

How do I pick which pool to trade in?

Look for depth and recent stable volume first, then check fee tiers and LP concentration; simulate your trade to estimate slippage and gas, and if an aggregator route looks much better, verify its path and reversion risk before submitting.

Can aggregators be trusted for large orders?

They can be helpful, but treat them like a router service that needs verification: simulate fills, split orders when necessary, and understand which pools and chains the aggregator will touch to avoid hidden latency or stale price sources.

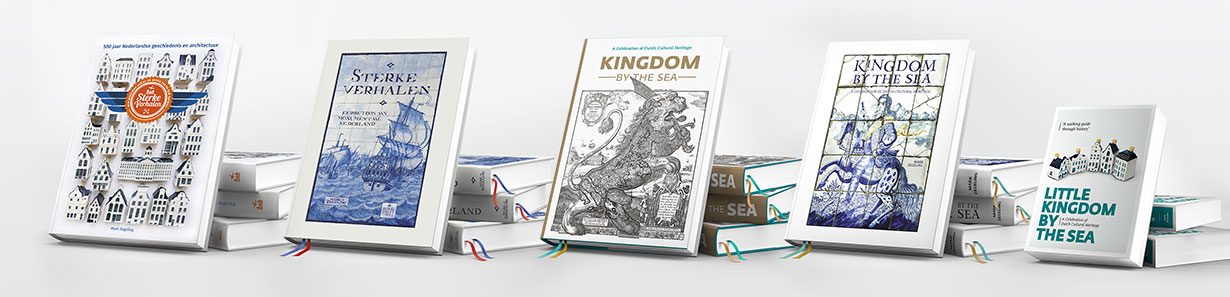

Mark Zegeling

Author Kingdom by the Sea,

A celebration of Dutch cultural heritage and architecture

Frits Bolkenstein

Frits Bolkenstein